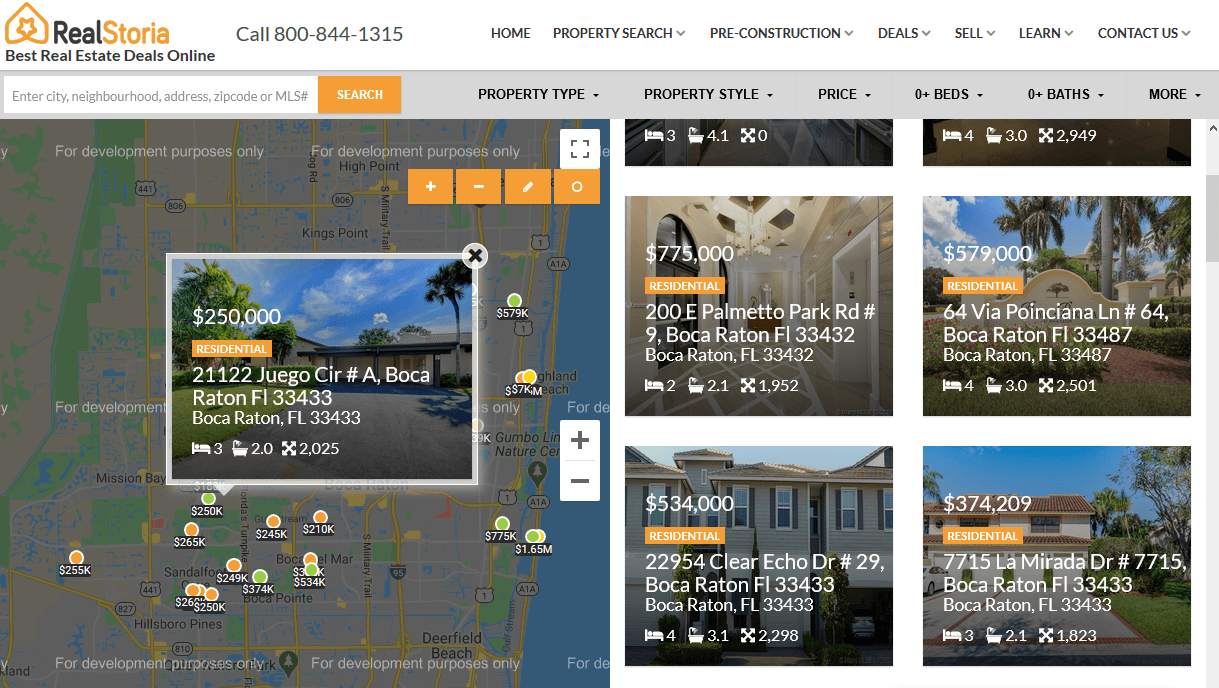

Mortgage Lending | Home Loans and Buyer Pre-Approval

Shop Mortgage Options & Compare Rates with Our Professionals!

Lots of companies offer loans, and each company has different loan types. If you go to the bank and ask for a quote they will only show you their products, but not their competitors. The first loan types they show you are also likely to make them the most money. Working with a mortgage broker for real estate in the Southeast Florida Area means you have someone who knows your financial situation, and shops around for the best offers from multiple lending companies. We know what criteria banks are looking for and how to help you qualify for the best possible loans. We only make money by finding you a good deal.

Benefits of working with us:

- Fixed Rates

- Adjustable Rates (ARM)

- Conforming Loans

- Jumbo & Super Jumbo Loans

- FHA, VA, & USDA Loans

- Terms Form 5 to 30 Years

- Proven Track of Record

- 20+ Years of Direct Lending Experience

- 52+ Awards for outstanding Productions, Growth and Customer Service

6 EASY STEPS TO BUY A HOME ONLINE

1 - Discuss Your Goals

Discuss your wants and needs for buying a homes or an investment property via phone, email or text with our agents.

2 - Get Pre-Approved

Apply for a mortgage with a local lender and see what your price range should be and determent what kind of loan best suits you.

3 - Locate a Property

Our agents will virtually walk you through the homes that you like and fit your criteria remotely and keep your family safe.

4 - Make An Offer

We'll set you up with an online account where you can sign digitally or upload documents from the comfort of your computer.

5 - Earnest Money Deposit

You'll have the choice to pay by a credit card, wire transfer from your bank account or we'll stop by and pick up a check from your home.

6 - Closing

When is time to sign the final paperwork, we can arrange a mobile notary, a digital e-signature, a drive-thru closing or a mail out.

Why Choose Us?

⇒ BEST RATES

We shop the best banks & wholesale lenders in the nation to help you.

⇒ 20+ YEARS IN A ROW

We have helped numerous home owners like you save time & money.

⇒ FULL TRANSPARENCY

View rates and the progress of an offer and transaction status.

⇒ VETTED LOAN ORIGINATORS

Get your accurate purchasing power in today’s market with confidence.

⇒ BETTER AGENTS

Work with top mortgage brokers and the best local service professionals.

⇒ FIRST TIME HOME BUYER

If this is your first home purchase then you are eligible for incentives.

Explore active listings

Core Values

Our Company Vision and Values lay at the core foundation of our business and what we hold each other accountable to. They guide our decisions as a company and demonstrated every day, both externally in our business relationships and internally with our coworkers.

- People - We believe that each person – every person – is important.

- Integrity - We fulfill our commitments, honor the trust placed in us and treat all others with respect and integrity.

- Communication - We communicate clearly, honestly and effectively on all aspects of our organization.

- Customers - We are dedicated to satisfying the needs of both our internal and external customers.

- Community - We believe that giving back to our community is a responsibility that also benefits us both individually and as a company.

New Construction homes in Boca Raton and Florida

I Want My FREE Mortgage Rate Quote!

With RealStoria Approved Partner - Contact now →

How the Loan Process Works

- Begin loan pre-approval process – Gather Required Documents

- W-2’s for all wage earners for the last 2 years

- Copies of the one months pay stubs for all wage earners

- Copy of Federal Tax Returns for the last 2 years (needed for self employed and investors only)

- Copies of 2 months checking bank statements

- Copies of the last 2 months savings bank statements (savings, 401(k), IRA’s, etc.)

- Copy of a valid driver’s license or government issued identification

- Apply and Get Pre-Approved

- This process helps you determine the amount you can borrow. Sign and complete the loan application and disclosures. At this time, income and credit verifications are completed as well as checks on your assets and liabilities. During the loan approval process, it is important not to significantly change the status of any of your financial accounts.

- Compare Loans and Rates

- Deciding on the loan amount and length of your loan period will help you determine if points and fees make sense. Do you plan to hold onto your property for an extended period? A fixed or a variable rate is one of many choices available to you. There are also several alternatives to points and fees. We can help you find the right loan program for you.

- Lock your rate

- Work with us to lock in your rate. You may be required to submit additional documentation before the loan can be approved. Your loan application will go through the final approval process which includes verifying the information submitted on your application. It is important to postpone making any major purchases or changing the status of your financial accounts. Large deposits and withdrawals must be documented. If you make any significant changes in your application information, please let us know beforehand.

- Close your Loan

- Review and sign loan documents. Check the documents carefully for the correct interest rate, loan amount, names and addresses. If you’re purchasing a property you may be required to bring a cashier’s check or to wire funds. Refinance loans on primary residences have a mandatory three-day rescission period.

Submit a Request to Get Pre-Approved